INERTIA Advisory - Weekly Newsletter - 21/03/2022

Welcome to INERTIA Advisory’s weekly newsletter, where you will receive updates on the most remarkable things happening in the cryptocurrency space.

Enjoy!

Guys, there is so much stuff going on in crypto right now that it is worth starting the newsletter with the following take by GordonGoner.eth, co-founder of YugaLabs and one of the creators of the Bored Ape Yacht Club (BAYC).

In fact, it seems that nothing is impossible for the team that created the largest NFT project in the world less than a year ago, as they are once again trending in the cryptocurrency space. The team behind BAYC just launched and airdropped (distributed for free) the ApeCoin, a token based on the BAYC project that NFT holders of the ecosystem were able to claim freely. The Yugalabs team stated that they will be implementing this token in the “Otherside” metaverse that they are working on.

To appreciate the magnitude of the airdrop, if you were a Bored Ape holder, you would be getting almost US $200k in $APE! For those of you who think that NFTs are a scam, look at what would you be getting if you held a Bored Ape since the project started.

INERTIA Advisory will be providing soon a full report on the token and potential utility that may have in the future. Stay tuned!

More news regarding the metaverse. HSBC becomes the latest corporate giant to enter the metaverse through a partnership with The Sandbox, one of the biggest decentralized metaverses in crypto. The British giant acquired a plot of land in a space that will be developed to entertain sports, e-sports, gaming, and finance professionals.

Mark Zuckerberg, Meta’s CEO, stated that its video and photo-sharing application, Instagram, is preparing to add NFTs (Non-Fungible Tokens) to the platform.

Considering that Web2 social media companies such as Twitter, Instagram, and TikTok embrace the introduction of NFTs. Could the adoption of JPEGs in NFT format become the catalyst for shifting the digital status perception as we know it today? Time will tell, however, in Crypto-Twitter followers and “blue checks” are not as important as they used to be. NFTs rule the space.

A friendly reminder that we are still so early on NFTs.

More TradFi (Traditional Finance) companies keep shifting into the cryptocurrency industry too. Two new players are joining their financial peers (JP Morgan, Visa, and Mastercard) in exploring possibilities and business cases in this promising technology.

American Express, the world’s second-largest payments processor, has filed seven trademark applications linked to virtual services and its iconic Centurion logo.

Stripe, the online payment company, is bringing its payment infrastructure to cryptocurrency-related companies, including exchanges, wallet providers, and NFT marketplaces. Take a better look here.

Moreover, Goldman Sachs conducts their first OTC (Over-the-Counter) Crypto trade with Galaxy Digital. The New York-based crypto-focused company disclosed the trade in a press release on Monday. The transaction was described in the statement as a Bitcoin non-deliverable option, a type of cash-settled cryptocurrency options trade.

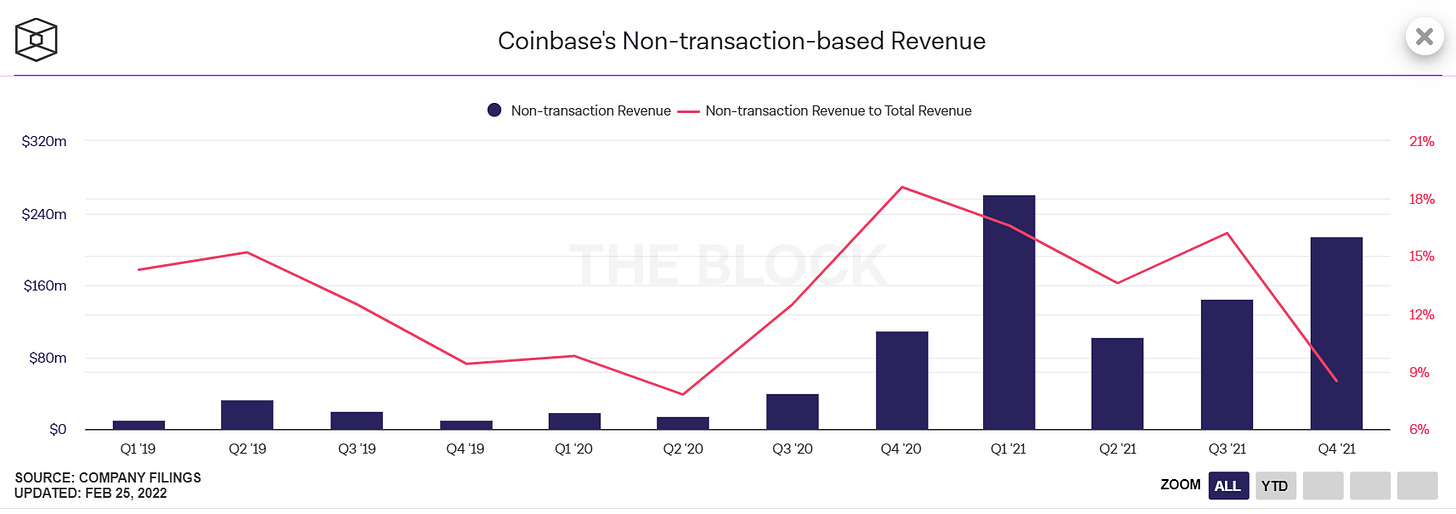

Coinbase, one of the largest cryptocurrency exchanges in the world, is looking to distance itself from transaction-based revenue. The exchange will implement Coinbase One, a subscription service that comes with $0 trading fees among other benefits such as dedicated 24/7 phone support and $1M Account Protection.

This looks like a surprising move by the company knowing that 96% of Coinbase’s total revenue comes from the spread charged to customers.

On the other hand, it is true that the cryptocurrency exchange business is becoming more and more competitive and margins decrease as time passes by. Thus, this move could be key for Coinbase to secure a spot as one of the top “Crypto Banks” in the long run.

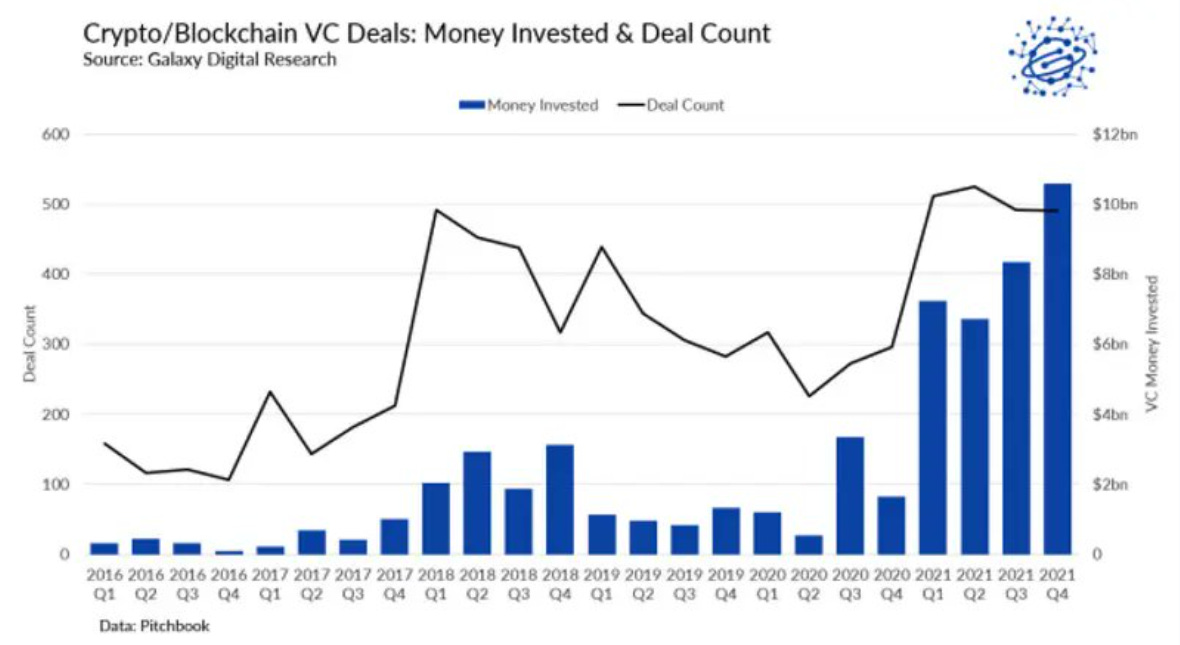

The global VC funding hit a record US $621 billion in 2021, a 111% increase year-over-year. However, crypto-related VC investments saw a much higher increase than other sectors compared to 2020. Just comparing the last quarter of 2020 and 2021, the total investment amount went from US $2 billion to US $10 billion, a 500% increase year-over-year.

However, investments aren’t slowing down in 2022. As a matter of fact, let’s see some of the financing rounds that happened (or are about to happen) only during the last week.

Roll-Up developers StarkWare to raise US $100 million at a $6 billion valuation.

Ethereum Layer2 Optimism raises US $150 million in Series B funding. The company is currently valued at US $1.65 billion.

ConsenSys announced the close of a US $450 million financing round, bringing its valuation to US $7 billion. However, All proceeds from the round will be converted to ETH (Ethereum token). WTF! Love to see this!!

Solana’s Top NFT Marketplace Magic Eden has raised US $27 million in a Series A led by VC firm Paradigm.

The US $155 billion investment giant, Bain Capital, launches a US $560 million crypto fund focused on DeFi and Web3.

Guys, follow smart money… All of them are in Crypto!

When talking about cryptocurrencies and their utility, I have always stated that crypto will be first adopted in underdeveloped countries where access to technology is getting easier and easier as time passes by. As a matter of fact, financial institutions and local central banks are being left behind by the value proposition that cryptocurrencies offer to citizens of these countries. A good proof of that is the spike in the number of crypto users that was seen in Africa in 2021.

The average number of monthly transactions across African countries has shown a 1,386.7% increase from January 2021 to January 2022. The number of users has also increased significantly, showing a 2,467.2% spike over the same period. The average amount per transaction has, however, decreased, indicating that the adoption of this technology is taking place not only for large transfers but for small payments as well.